Untuk Kamu Yang Ingin

Memulai Karir

Perlindungan masa depan untuk kamu yang baru mulai berkarir.

Menjaga Kesehatan

Jalani aktivitas secara produktif dan maksimal bersama BNI Life.

Proteksi & Investasi

Perlindungan jiwa optimal lengkap dengan alternatif investasi yang fleksibel.

Merencanakan Pendidikan Anak

Rencanakan dana pendidikan anak kamu dari sekarang sebelum inflasi menyerang.

Tenang di Hari Tua

Persiapan hari tuamu harus dimulai dari sekarang.

Melindungi Karyawan (Kumpulan)

Berikan rasa aman bagi karyawan dengan perlindungan tepat.

Perlindungan Syariah

Perlindungan optimal berdasarkan prinsip syariah.

Proteksi Tepat

Kami hadir memberikan proteksi untuk segala kebutuhanmu.

BNI Life Video

Temukan video-video inspiratif dari kanal youtube BNI Life.

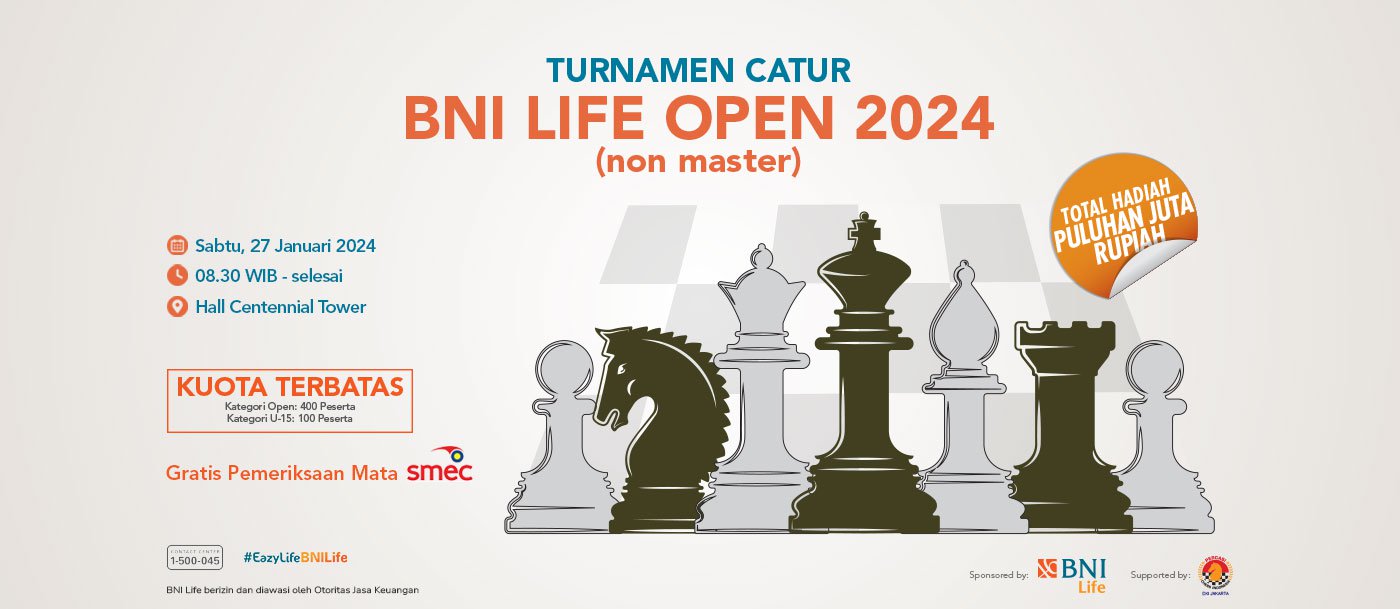

Olah Raga Bagi Lansia

Atasi Influenza, Pilek dan Komplikasinya

Durasi Olah Raga untuk Usia 50 Thn

Dosis Vitamin untuk menjaga Imunitas Tubuh | Kesehatan & Nutrisi Harian

Kumpulan Artikel

21 Maret 2025

Batu empedu adalah salah satu penyakit pencernaan yang sering kali tidak menunjukkan gejala di tahap awal

Group Perusahaan

BNI Life merupakan bagian atau anak perusahaan dari BNI.

.jpg)